Manage workplace pensions easily

Eliminate human error on manual calculations

One central location

Pension Integrations

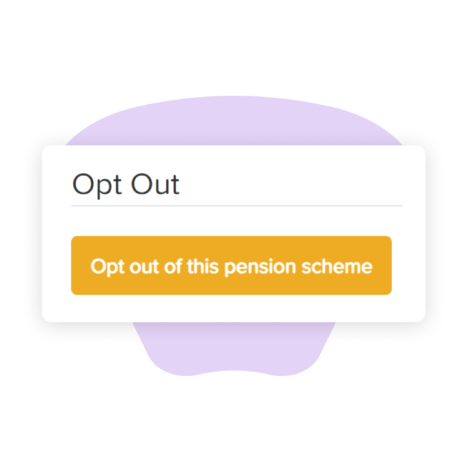

Once an employee has been automatically enrolled in a pension scheme, you can opt-out employees out of the scheme during your specified opt-out period. Available for the 6 main auto enrolment providers (NEST, The People’s Pension, NOW: Pensions, Aviva, Smart Pension and Legal & General).

Automated workplace pension submissions FAQs

An automated pension submission feature allows employers to submit pension contributions to their employees’ retirement accounts automatically. This system is typically integrated with the payroll software, so pension contributions are deducted from the employee’s salary and transferred directly to their pension account.

A workplace pension scheme is a pension that is set up by the employer, to help employees save for their lives after work.

Pension auto-enrolment is a duty, by law, for every employer. Employers must automatically enrol employees, if eligible, to their workplace pension scheme.

Innovation, reliability, customer service.

A tick, gold medal, five stars.

over the past year